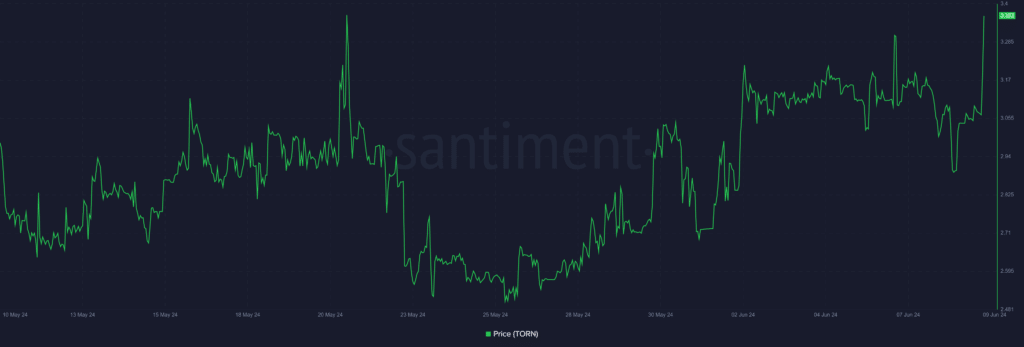

Tornado Cash (TORN) price and defi total value locked (TVL) surged while the broader crypto market has been consolidating in bearish condition.

TORN is up by 11.8% in the past 24 hours and is trading at $3.36 at the time of writing.

The asset’s market cap surpassed the $17 million mark with a daily trading volume of $51,000. TORN is currently the 957th-largest cryptocurrency.

Moreover, the asset briefly touched an intraday high of $3.39 earlier today, at around 08:40 UTC.

Despite the current price rally, TORN is still down by 99.23% from its all-time high of $437.41 on Feb. 13, 2021. Notably, the Tornado Cash token touched an all-time low of $1.31 on Jan. 10 — five months ago.

The TORN price rally comes while the global crypto market capitalization recorded a 0.5% decline in the past 24 hours and is currently hovering at $2.67 trillion.

According to data provided by Defi Llama, the TVL in the Tornado Cash defi protocol increased by 7% over the past day, reaching $614.18 million — a level last seen on May 5, 2022. Wrapped Ethereum (WETH) has the largest token allocation in the protocol.

Data shows that the Tornado Cash defi protocol, an Ethereum-based privacy tool, witnessed $41.63 million in USD inflows today.

Tornado Cash’s downfall started in August 2022, when the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned the platform over money laundering. Notably, authorities arrested its founder, Alexey Pertsev, in the Netherlands a few days after the announcement of the sanctions.

On May 30, Ethereum co-founder Vitalik Buterin donated 30 ETH to the Juicebox campaign “Free Alexey & Roman,” showing support to the Tornado Cash developers.