Helium token suffered a reversal on Aug. 15 amid profit-taking and worsening sentiment in the crypto industry.

The Helium (HNT) crypto price retreated to $6.50, down by over 13% from its highest point this week, indicating it has moved into a local correction.

HNT is up by 126% from August low

Despite its pullback, HNT remains one of the best-performing cryptocurrencies since Aug. 5, when most tokens retreated. It has surged by over 126% from its lowest point this month, pushing its market cap to over $1 billion.

Helium’s retreat coincided with the crypto fear and greed index dropping from this month’s high of 57 to 43. If the decline continues, the index could move into the fear zone, below 40.

The decline also occurred as Bitcoin (BTC), Ethereum (ETH), and other altcoins retreated. Bitcoin fell from this week’s high of over $60,000 to $58,000 while Ether, Solana (SOL), and Binance Coin (BNB) were down by over 4% in the past 24 hours.

Helium has solid fundamentals

Helium has become one of the top-performing cryptocurrencies in recent months, bolstered by its ecosystem growth.

The network is reportedly in talks with two major U.S. carriers, who are conducting tests to offload their traffic onto the MOBILE network. Carrier 1 has over 185,000 subscribers, while Carrier 2 has over 122,000 users participating in the trial.

If successful, the carriers could save money and offer better coverage, while Helium would benefit from increased traffic and funds, which would flow to hotspot providers.

According to its stats page, Helium MOBILE has almost 20,000 active hotspots, while its IoT solution has 360,000 locations, and these numbers are rising.

HNT formed a golden cross

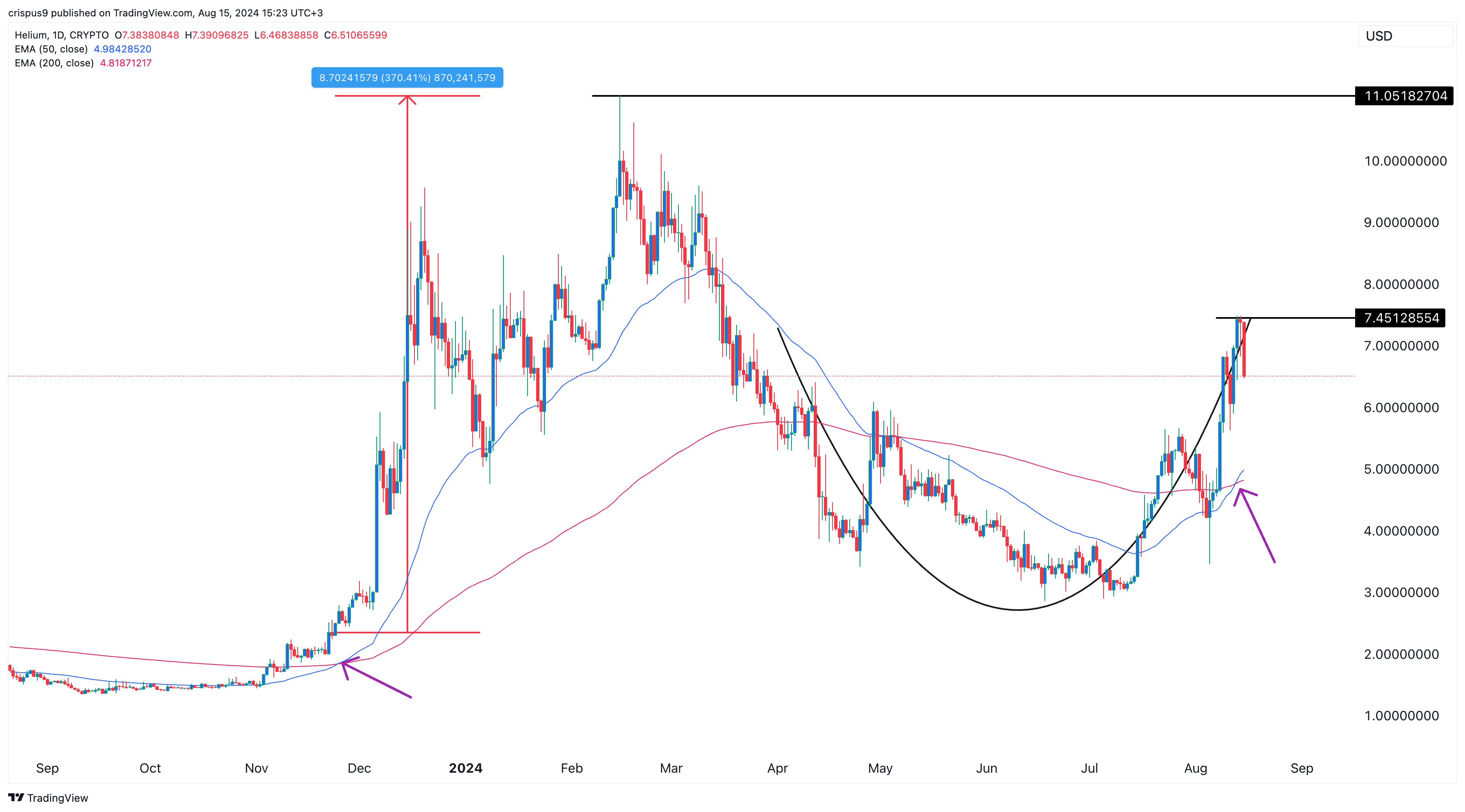

Technicals suggest that the HNT token could resume its upside as it recently formed a golden cross pattern, with the 200-day and 50-day Exponential Moving Averages making a bullish crossover.

In most cases, this pattern leads to further upside. For example, the last time HNT formed this cross in November 2023, the Helium token soared by over 370%.

Helium has also formed a rounded bottom, another bullish pattern. A cross above this week’s high of $7.45 could signal more upside as buyers target the year-to-date high of $11.05, 70% above its Aug. 15 level.