Injective gained bullish momentum on Wednesday, Sept. 4, after a set of consecutive declines over the past two weeks.

Injective (INJ) is up 10% in the past 24 hours and is trading at $17 at the time of writing. The asset’s market cap is currently hovering around the $1.6 billion mark, making it the 45th-largest cryptocurrency.

INJ’s daily trading volume surged 24%, surpassing the $100 million mark.

Moreover, INJ briefly reached an intraday high of $17.58 amid increased selling pressure from whales.

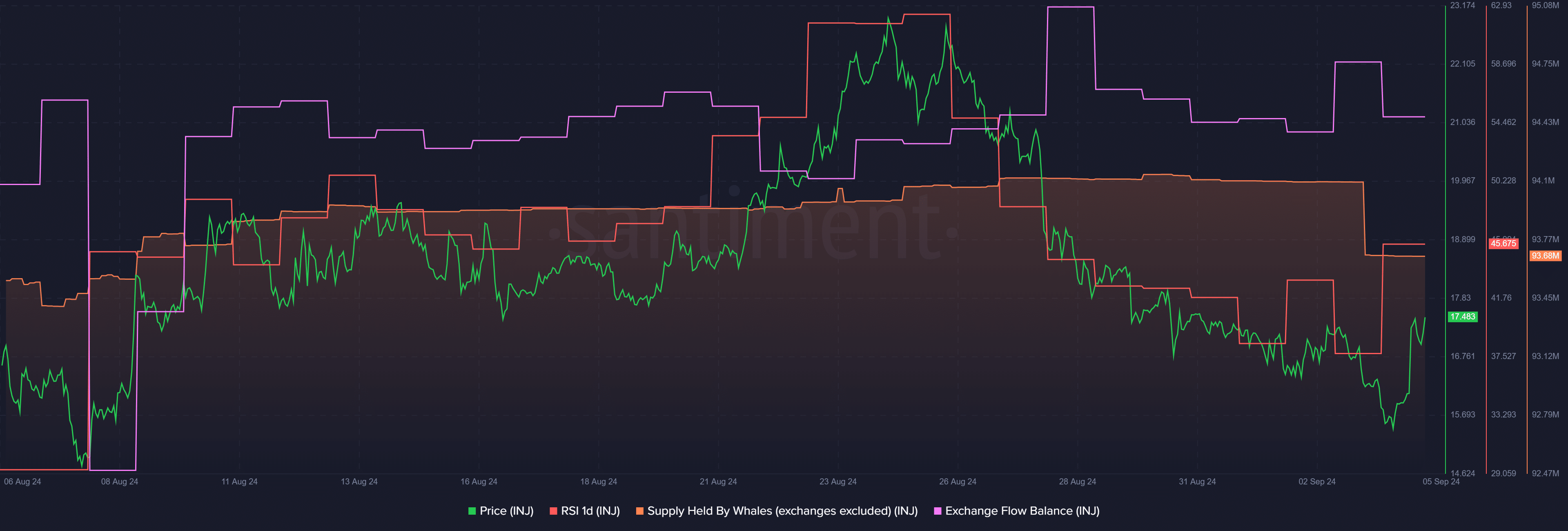

According to data provided by Santiment, the amount of INJ supply held by whales declined from 94 million on Sept. 3 to 93 million at the reporting time. This movement shows that some whales have already sold their Injective holdings as the price was falling to $15.3.

Data from the market intelligence platform shows that the Injective exchange net inflows have also declined from 49,200 to 6,900 over the past day. The decreasing amount of exchange net flows could hint at lower selling pressure.

This could put the INJ price in the consolidation zone until it gains strong momentum. However, it’s important to note that the market dynamics can change due to numerous factors.

Injective’s Relative Strength Index is currently sitting at 45, per data from Santiment. The indicator shows that the asset is witnessing neutral movements from investors at this price point.

One of the bullish drivers of the INJ price was the company’s launch of a tokenized index that tracks BlackRock’s BUIDL fund’s supply.