Bitcoin’s price movements have historically impacted the broader crypto market, sending waves of mixed signals around altcoins.

This time, Bitcoin’s (BTC) fall below the $98,000 mark brought a market-wide downturn, majorly impacting small-cap altcoins. The global crypto market capitalization dropped by 2.3% over the past day, reaching $3.47 trillion, according to data from CoinGecko.

The crypto market value even reached a daily low of $3.38 trillion, wiping over $120 billion, before gaining upward momentum again.

Consequently, the total crypto liquidations increased by 35%, reaching $494.5 million, according to Coinglass data. Of this tally, $366 million are longs and the remaining $127.8 million are short positions.

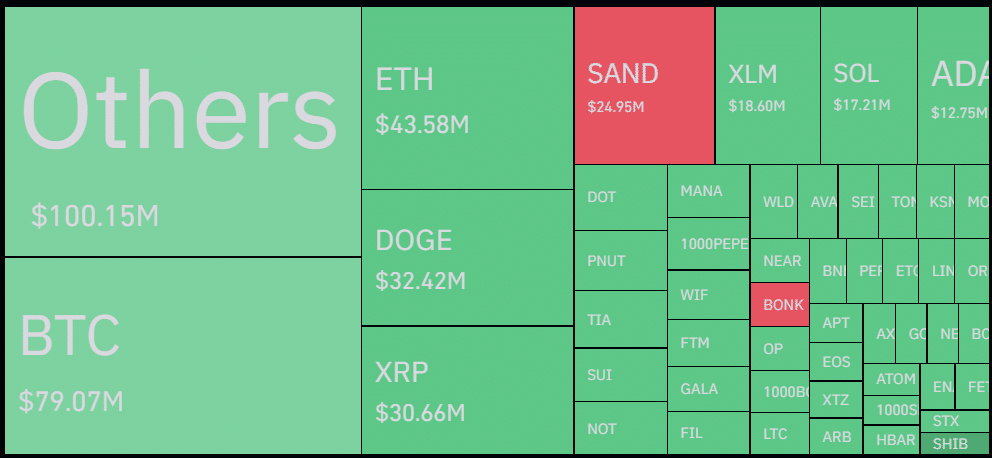

Small-cap altcoins recorded over $100 million in liquidations in the last 24 hours — $83.7 million long and $16.4 million shorts — surpassing Bitcoin’s $79 million — $56.4 million longs and $22.6 million shorts.

According to data provided by Coinglass, The Sandbox (SAND) is the only major altcoin with dominating short liquidations as its price registered a 31% rally over the past day. Bonk (BONK) also has a slightly bullish liquidation map due to its wild roller coaster ride between $0.0000431 and $0.0000486.

The leading altcoin, Ethereum (ETH), recorded $43 million in liquidations over the past 24 hours, with long positions dominating, as it fell 1.1% to $3,385.

Data shows that Binance, OKX and Bybit crypto exchanges are leading with $216 million, $120 million and $116 million in liquidations, respectively.

The single-largest liquidation, worth $13 million in the BTC/USDT pair, also happened on Binance, the largest cryptocurrency exchange by trading volume.

Most notably, this market-wide correction would be considered normal at this point due to the overheated and greedy market conditions.

Another wave of upward momentum for Bitcoin could potentially trigger further bullish sentiment among market participants, impacting altcoins as well.