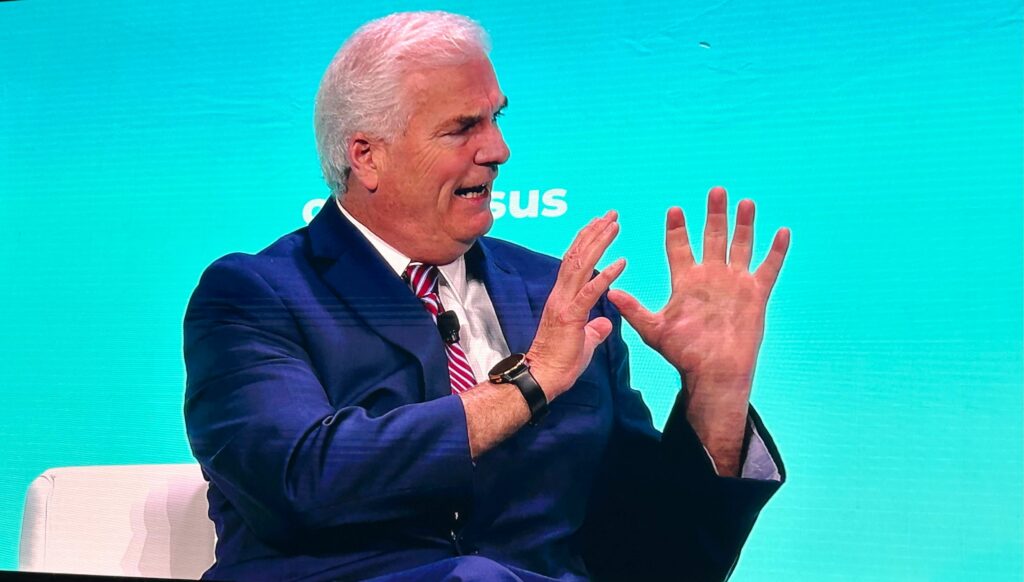

Speaking at Consensus 2024, Republican majority whip Tom Emmer shared his perspective on cryptocurrency regulatory efforts in Washington D.C.

Following several bankruptcies and FTX’s crash in 2022, crypto has remained a hot topic among U.S. policymakers as industry stakeholders like Coinbase lobbied for clear rules.

Regulators like the Securities and Exchange Commission (SEC) and Senators like Elizabeth Warren from Massachusetts adopted an anti-crypto approach, initiating industry crackdowns and calling for tighter rules on digital asset operations.

On the surface, crypto seemed locked in an uphill battle, but advocacy and rapid blockchain adoption have impacted discussions in Washington within both Democrat and Republican parties.

According to Congressman and House majority whip Tom Emmer, votes for the Financial Innovation and Technology for the 21st Century Act (FIT 21) and opposition to the SEC’s controversial Staff Accounting Bulletin 121 (SAB 121) showed a bipartisan stance to safeguard U.S. innovation and check the SEC’s unconstitutional advanced against crypto.

“He has gone way beyond the authority that he has. He literally violates the mission of the SEC every day,” Emmer said, referring to SEC Chair Gary Gensler.

The GOP majority whip also hinted that Warren’s influence in the White House may be declining, paving the way for more neutral merit-centric digital asset discussions. In Emmer’s view, the White House’s statement on FIT 21 indicated a willingness to negotiate and find common ground on legislation as elections approach.

Crypto regulatory timeline

Emmer opined that this election year may motivate concluding rules but stressed that nothing is certain. The Congressman said FIT 21 remains subject to markups in the Senate and likely returns to the House for further hearings.

An anti-CBDC bill is also on the agenda, as policymakers slammed the Federal Reserve for conducting a central bank digital currency pilot and initiative development without Congressional approval.

Emmer believes work on crypto bills will advance after the elections and that digital asset voters could sway votes. The comments mirrored sentiments shared by CoinShares chief strategy officer Meltem Demirors during the Consensus OG Survivors panel. Demirors stated that American policymakers can’t ignore some 40 million constituents invested in digital assets.